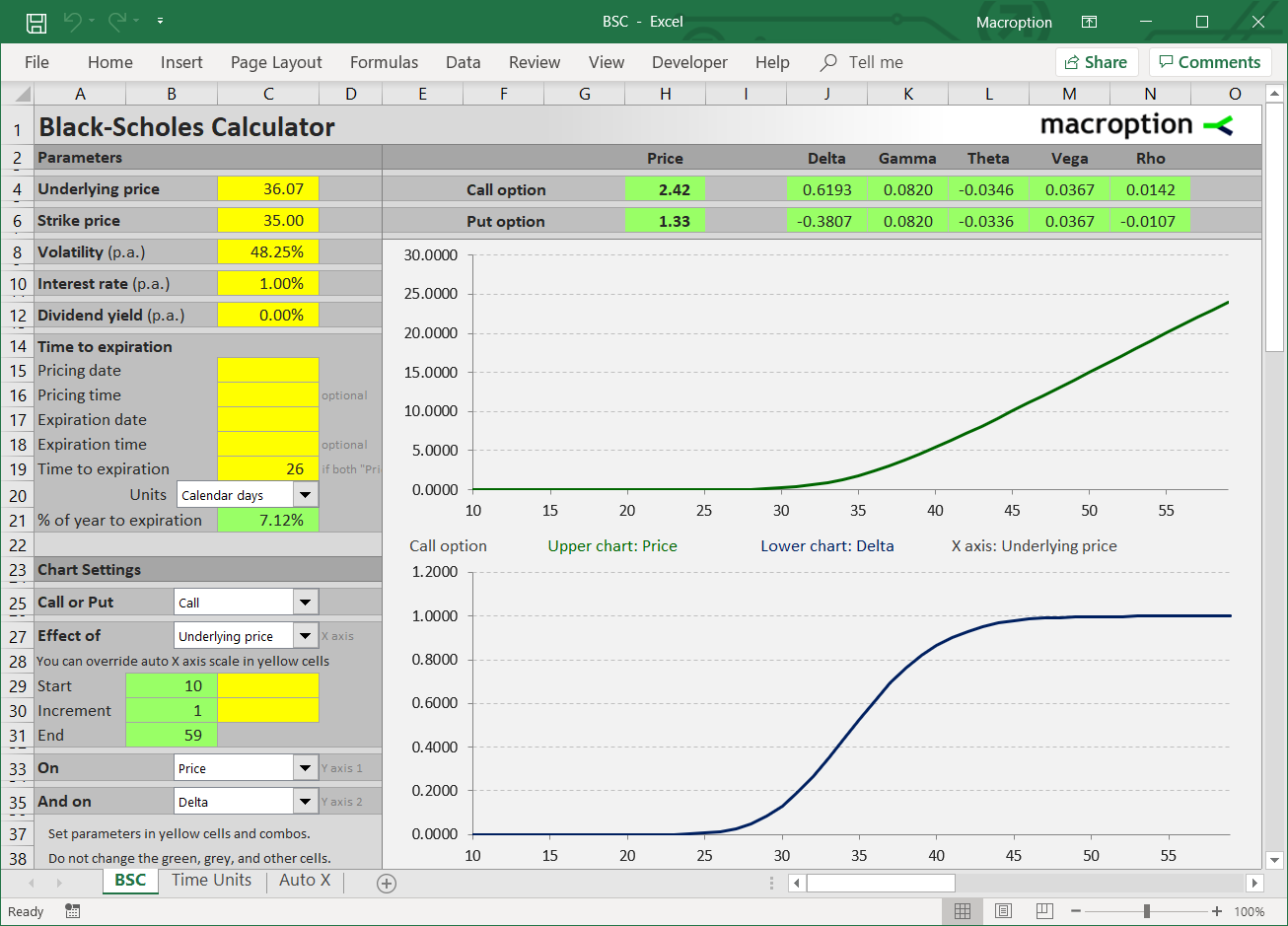

- Instantly calculate call and put option prices in Excel

- Calculate and plot Greeks – delta, gamma, theta, vega, rho

- Analyze effects of different factors on option prices and Greeks

- Simple navigation, easy to use even with limited Excel or finance skills

- Based on Black-Scholes model + Merton's extension to account for dividends

- Can also be used for futures options (Black-76 model)

- Can also be used for currency options (Garman-Kohlhagen model)

- Works in all versions of Excel from Excel 97 to the latest, including Excel for Mac

- Detailed user guide and support

$39 one-time payment

Instant download

How It Works & Screenshots

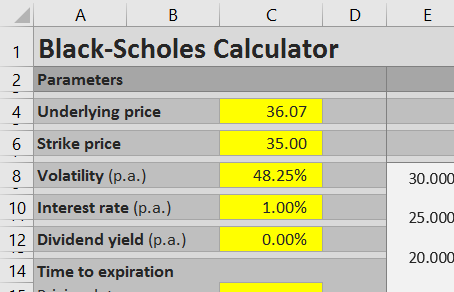

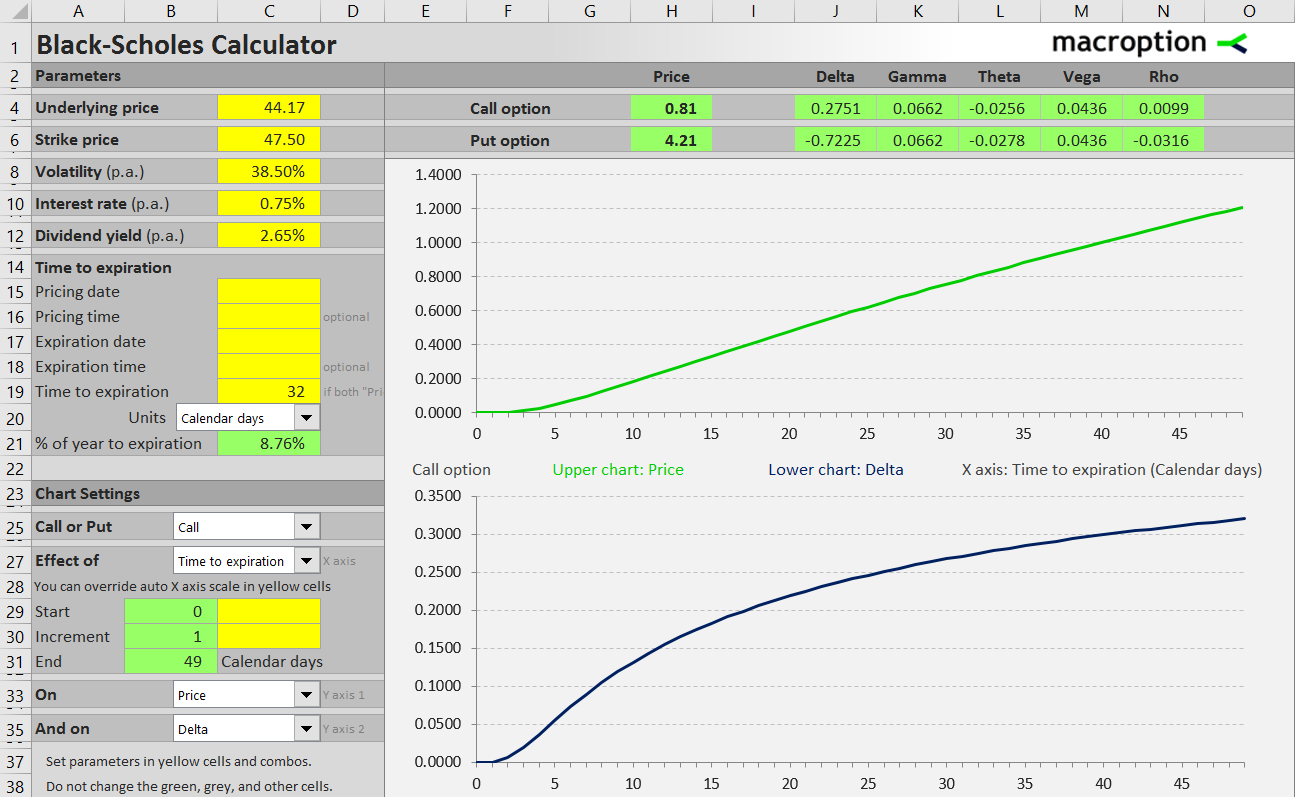

Enter parameters in the yellow cells: underlying price, strike price, volatility, interest rate, dividend yield. The user guide provides detailed explanation of each.

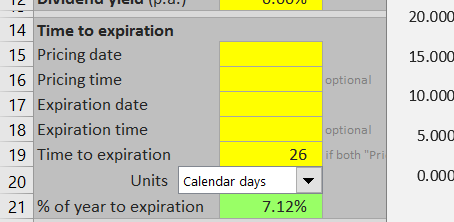

You can set time to expiration either as pricing date and expiration date, or as number of days remaining to expiration. The calculator also works with fractions of days to handle intraday pricing.

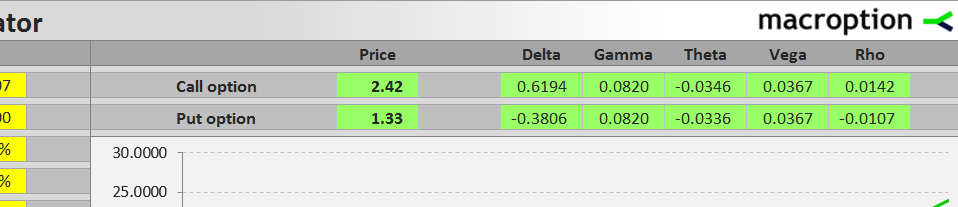

You will instantly see the resulting option price and Greeks. The Greeks, like delta, gamma, theta or vega, measure sensitivity of option prices to changes in the individual parameters and therefore are very useful for managing option positions. You can find detailed explanation of the Greeks in the user guide.

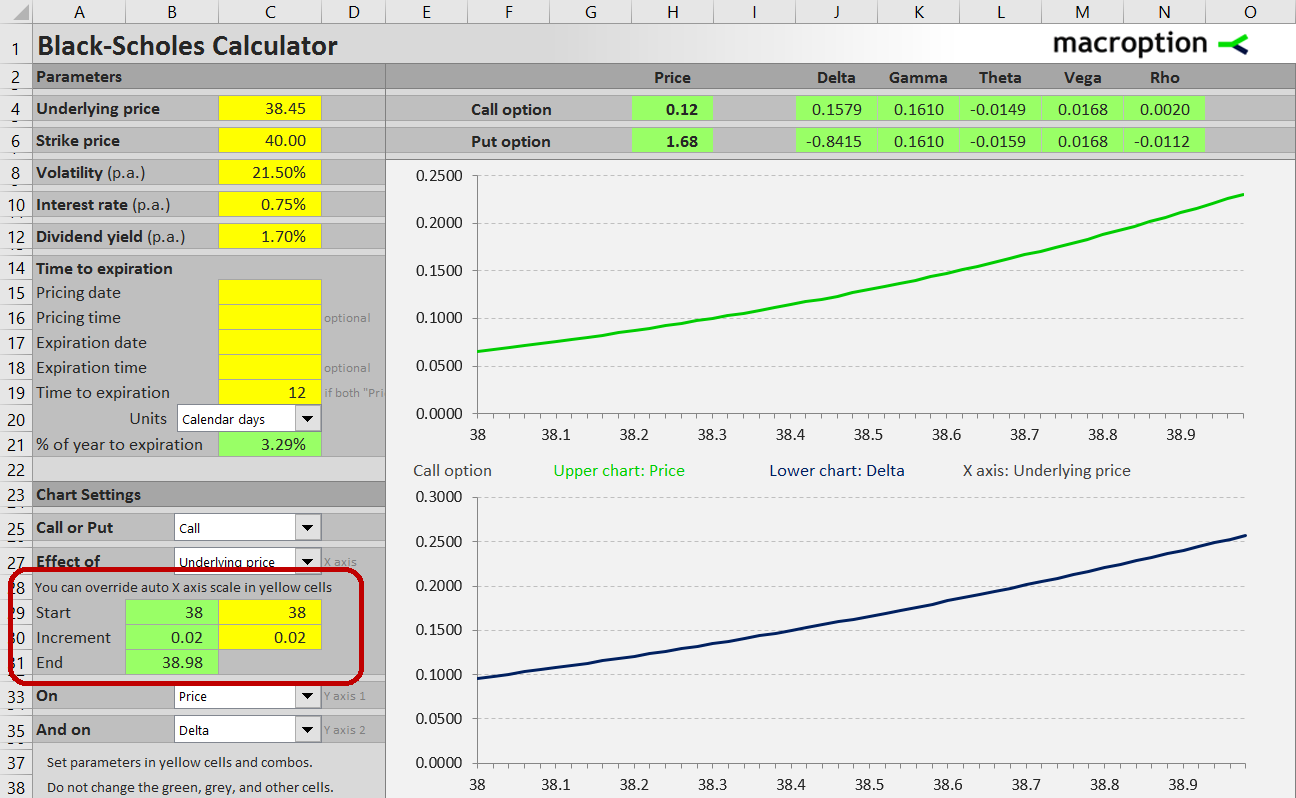

For even better understanding of your option's exposure to different factors you can see the effects of changing underlying price, volatility or time to expiration in the charts.

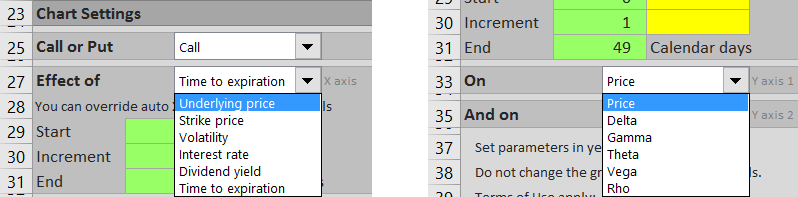

For instance, the screenshot below shows the effect of time to expiration on a call option's price and delta, demonstrating how this particular option will lose value as it gets closer to expiration.

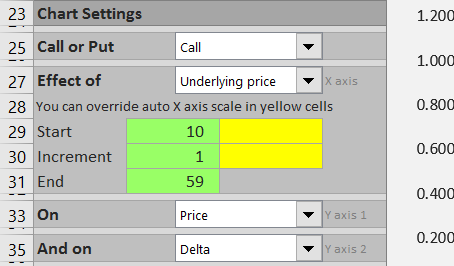

You can control the charts in the chart settings area on the left.

The charts can display effects of any of the parameters on an option's price and/or any of the Greeks.

You can also easily adjust the scale to zoom in or out.

The calculator helps you stay in control, understand the risks and behaviour of a position under any possible situation, and make faster and better decisions.

$39 one-time payment

Instant download

User Guide

Besides detailed step-by-step instructions for using the calculator, the guide also explains the assumptions and theoretical background of the Black-Scholes option pricing model, provides all the formulas for option prices and Greeks, and explains the particular Excel implementation.

Black-Scholes Calculator Guide Contents

- Quick Start ...3

- Main Sheet Overview ...6

- Calculating Option Prices ...7

- The Greeks ...12

- Simulations and Charts ...16

- Estimating Volatility ...21

- Option Pricing Model and Assumptions ...24

- Formulas Used ...27

- Calculation Area and Functions Used ...29

- Common Technical Problems ...32

- References ...33

- Contact and Terms of Use ...34

More assistance is available via email support.

$39 one-time payment

Instant download

Frequently Asked Questions

Is it a one-time payment or monthly/recurring?

One-time payment, yours forever.

Does it work in my version of Excel?

The calculator is a standard xlsm file and works in all versions of Excel from Excel 97 to the latest, also including Office 365 and Excel for Mac. For older versions you may need to use a different version of the calculator, which is also included.

Does it work in OpenOffice / LibreOffice / Apple Numbers / other spreadsheet software?

It may work in some, but unfortunately I can't guarantee it and can't provide support for software other than Microsoft Excel. That said, unlike our other calculators, the Black-Scholes Calculator does not require Excel macros to run, so it is enough if your software can open xls/xlsx files and work with standard Excel formulas.

Are the formulas freely available?

Yes. The calculator only uses the basic built-in Excel formulas or their combinations. Everything is freely available, nothing hidden or password protected. You are free to change any formulas and customize the calculator.

Does it work for American/European options?

The Black-Scholes model is intended for European options. In most cases (when early exercise does not make sense), it is also accurate for American options, but there are some exceptions (deep in the money puts, high dividend calls) where American options are more valuable than European options. In such cases it is more accurate to use binomial models than Black-Scholes (see Binomial Option Pricing Calculator).

Does it work for options in my country?

Yes. The model does not depend on a particular country or currency. Since 2013, the calculator has been used by customers all over the world, including the US, Europe, Australia, India, China, Japan, Russia, Brazil, and many other countries.

How do I pay? Is it secure?

You can pay by credit/debit card or PayPal. All payments are processed by PayPal, but you don't need a PayPal account to check out when paying with a card. Contact me for alternative ways to pay (wire transfer, bitcoin).

I have other questions / need more information.

Please contact me.

$39 one-time payment

Instant download

Related Calculators – Often Bought Together

Implied Volatility Calculator – Does the inverse of the Black-Scholes Calculator: Calculates IV from option prices and helps you understand the essential volatility input.

Binomial Option Pricing Calculator – Calculates option prices and Greeks using binomial models, the other main option pricing method besides Black-Scholes.

Option Strategy Payoff Calculator – Good to learn about individual option strategies and their payoffs at expiration. Draws payoff diagrams; calculates max profit, max loss, risk-reward ratios and break-even points.