Possible VIX Value Range

VIX (CBOE Volatility Index) can theoretically reach any value from zero to positive infinite. It can not be negative, but there it no theoretical limit on the upside.

VIX can definitely go over 100.

Actual VIX Value Range

In reality, VIX over 100 would be very unusual. In fact, the VIX index has never been above 100 any time during its available data history (since 1990).

The highest VIX close ever recorded was 82.69 on 16 March 2020 when the covid pandemic started. Taking also intraday moves into consideration, the all-time high in VIX has been 89.53 on 24 October 2008 (during the peak of the financial crisis).

You can find more details about these highs, as well as tables with other record VIX readings here (and here is similar statistics for all-time lows).

VIX Would Have Been Over 100 during the 1987 Crash

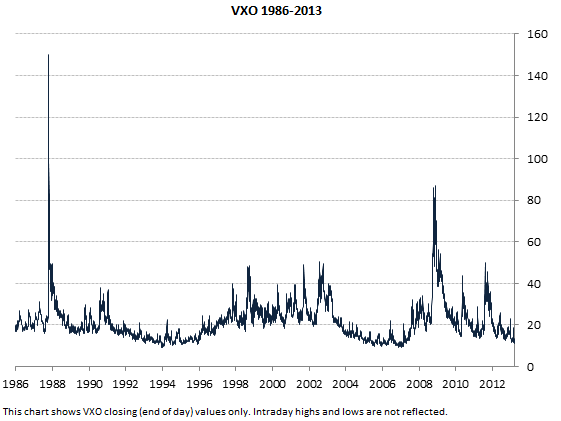

Although there is no VIX historical data covering that period, it is almost certain that the VIX would have been way over 100 during the market crash in October 1987. In fact, there is data available for VIX calculated using the old methodology (which was used until 22 September 2003), now known under the ticker symbol VXO, that goes back to 1986.

VXO closing value on the Black Monday (19 October 1987) was 150.19. Intraday high was 172.79 the day after. Although the calculation of VXO is slightly different from VIX, their values are very similar. It is safe to conclude that based on the available VXO data the VIX would have been way over 100 in 1987.

More Explanation

If you are not much familiar with VIX and volatility (which is measured by the VIX), you can find more explanation here: