When you work with options, you often need to quickly calculate historical volatility of a security. Unfortunately, most of the common tools, including highly priced trading software, have serious limitations:

- You can't calculate non-centered (zero mean) HV, which many volatility traders actually use.

- There is no documentation and you don't know which exact formula the particular software is using.

- Changing the HV period takes a lot of clicks or isn't possible at all.

I have created this Excel calculator to address these limitations.

- Centered and non-centered HV calculation + one more method

- Any period length

- Charts

- Works in all versions of Excel from Excel 97 to the latest, including Excel for Mac

- Very simple navigation – start using it immediately

- Detailed user guide if you need to know more

$39 one-time payment

Instant download

How It Works & Screenshots

Enter historical prices in the sheet "Data". You simply paste your data there and click a button:

The calculator will check the data for errors, sort it, import it to the calculation sheet,

and build the formulas for historical volatility calculation. You will get a message with the result:

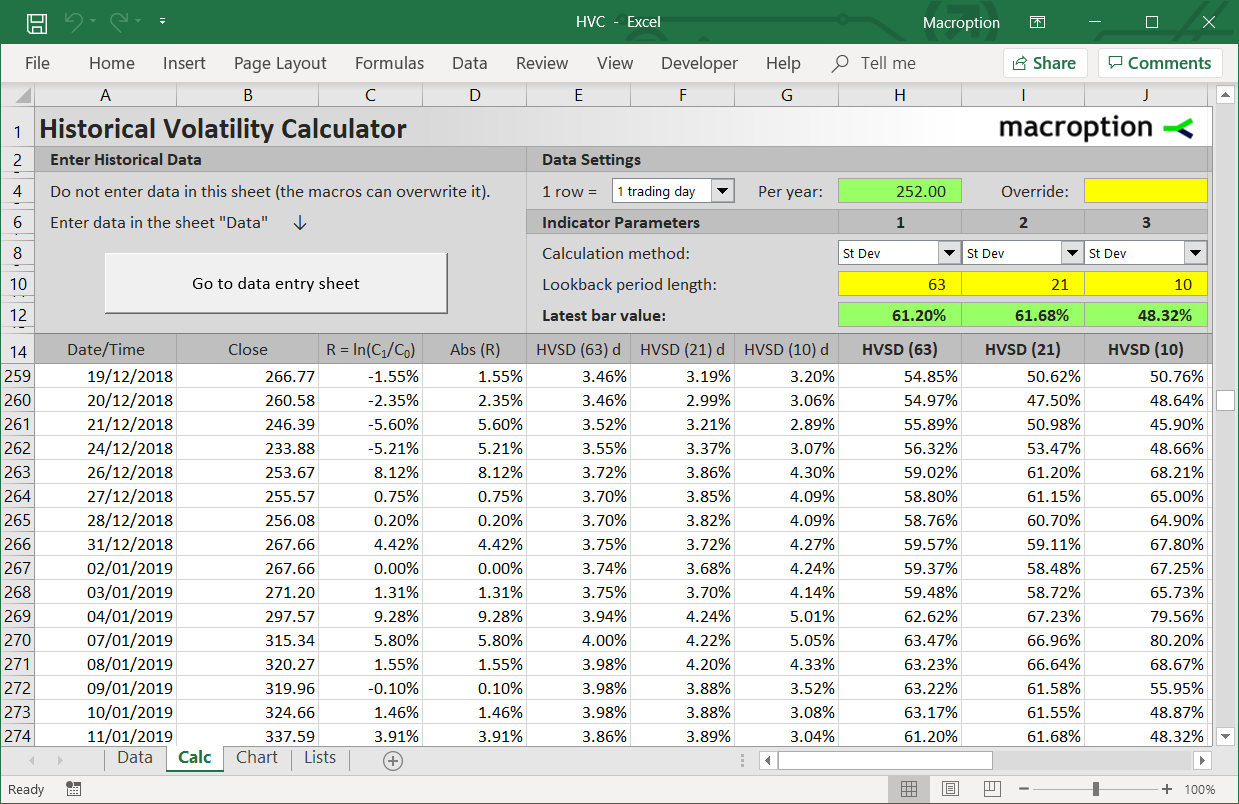

You can easily select calculation method and change HV lookback period length.

The calculator can display 3 different indicators at the same time (with different periods or calculation methods). For your convenience, historical volatility for the latest date is displayed at the top – no need to scroll down.

Of course, you can also scroll down to see HV for earlier dates. All formulas are freely available, if you want to explore and understand the particular Excel implementation.

Charts show the history of price and historical volatility.

You can easily control the charts using combos. No need to manually change Excel chart settings.

Using the calculator is fast and simple. No need to waste time trying to figure out Excel formulas and settings – focus all your attention on the market to make faster and better decisions.

$39 one-time payment

Instant download

Supported HV Calculation Methods

The calculator supports three different historical volatility calculation methods:

- Standard deviation of returns. This is the most widely used method and you will also find it in most finance books and resources. It is also called centered historical volatility.

- The zero mean method, also called non-centered historical volatility or less formally "ditching the mean". It is not much known among the wider public, but quite frequently used by options and volatility traders.

- Adjusted mean absolute deviation – one of alternative methods, introduced by Ederington and Guan in their 2004 paper titled Measuring Historical Volatility.

Detailed explanation of all methods, including their exact formulas, strengths, weaknesses and tips for practical use, is available in the user guide.

Historical Volatility Calculator Guide Contents

- Introduction ...3

- The Main Sheet ...6

- Entering Market Data ...7

- Setting and Changing Parameters ...14

- Historical Volatility Calculation Methods Explained ...17

- Lookback Period Length ...24

- Viewing Results and Charts ...26

- Common Technical Problems ...30

- Contact and Terms of Use ...31

More assistance is available via email support.

$39 one-time payment

Instant download

Frequently Asked Questions

Is it a one-time payment or monthly/recurring?

One-time payment, yours forever.

Does it work in my version of Excel?

The calculator works in all versions of Excel from Excel 97 to the latest, also including Office 365 and Excel for Mac. For older versions you may need to use a different version of the calculator, which is also included.

Does it work in OpenOffice / LibreOffice / Apple Numbers / other spreadsheet software?

It may work in some, but unfortunately I can't guarantee it and can't provide support for software other than Microsoft Excel.

How do I pay? Is it secure?

You can pay by credit/debit card or PayPal. All payments are processed by PayPal, but you don't need a PayPal account to check out when paying with a card. Contact me for alternative ways to pay (wire transfer, bitcoin).

I have other questions / need more information.

Please contact me.

$39 one-time payment

Instant download

Related Calculators – Often Bought Together

Black-Scholes Calculator – Calculates option prices and Greeks using the Black-Scholes-Merton model.

Implied Volatility Calculator – Calculates implied volatility from option prices.