This section provides reference and trading tips for different option strategies.

If you know a strategy by name, the easiest way to find it is in the list of all option strategies (sorted alphabetically).

Alternatively, browse the popular strategy groups or find a strategy by exposure (bullish, bearish, long volatility, non-directional) or risk profile (limited risk, limited profit, limited both risk and profit).

Option Strategy Groups

- Single Leg

- With Underlying

- Straddles

- Strangles

- Butterflies

- Condors

- Vertical Spreads

- Calendar Spreads

- Diagonal Spreads

- Ratio Spreads

- Ladders

- Box Spreads

- Synthetics

Option Strategies by Exposure

The main factors which drive option prices and, as a result, option strategy profit or loss, are underlying price and volatility. Some strategies react primarily to underlying price direction, others mainly to volatility, and some strategies to both. By their exposure to price and volatility we can distinguish four main groups of option strategies:

Bullish strategies – These tend to profit when underlying price goes up

Bearish strategies – These profit when underlying price goes down

Long volatility strategies – These strategies profit when underlying price makes a big move or implied volatility goes up

Non-directional strategies – These strategies benefit from sideways market or a decrease in volatility (or mere passage of time without big moves)

Option Strategies by Risk and Profit Potential

Another way to classify option strategies is by risk profile – whether a particular strategy has limited or unlimited risk (maximum possible loss) and potential profit. There are three kinds of strategies:

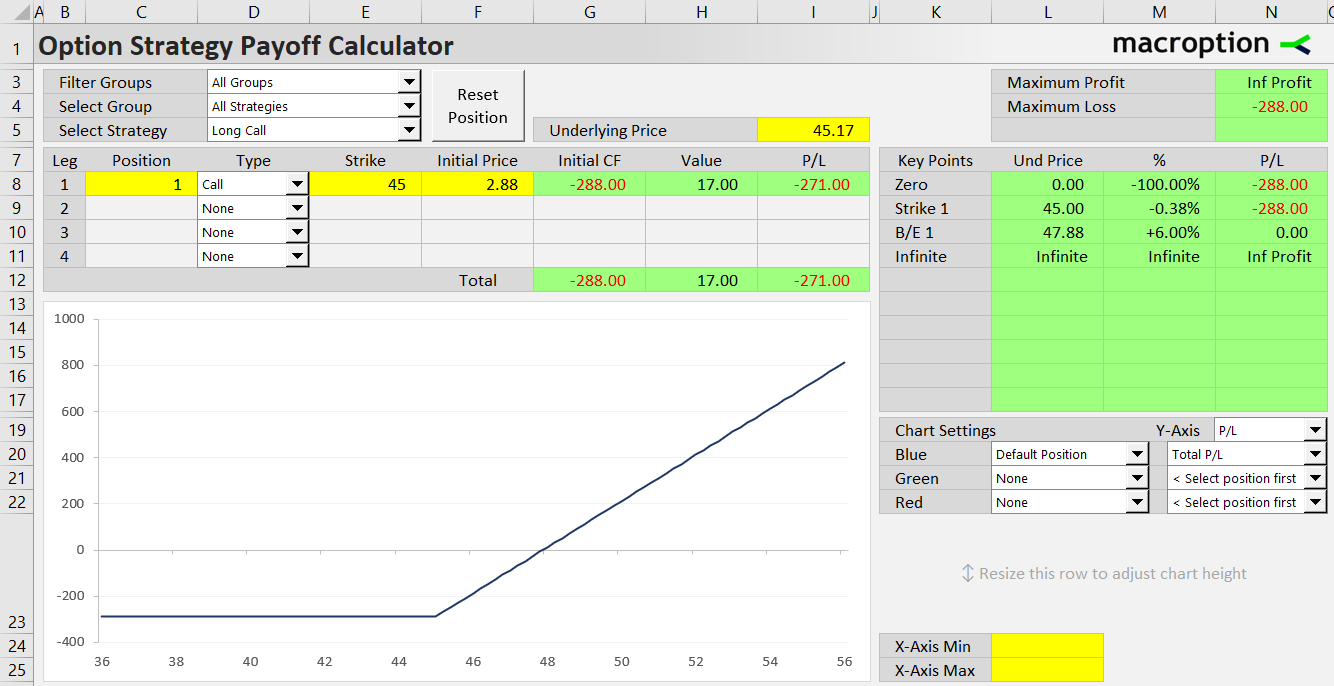

Strategies with limited risk and unlimited potential profit. These tend to be net long call options or net long the underlying asset. The theoretically unlimited profit occurs when underlying price goes up, as most underlying assets have no limit on how high their prices can theoretically go.

The simplest example of an option strategy with unlimited risk and limited profit is long call.

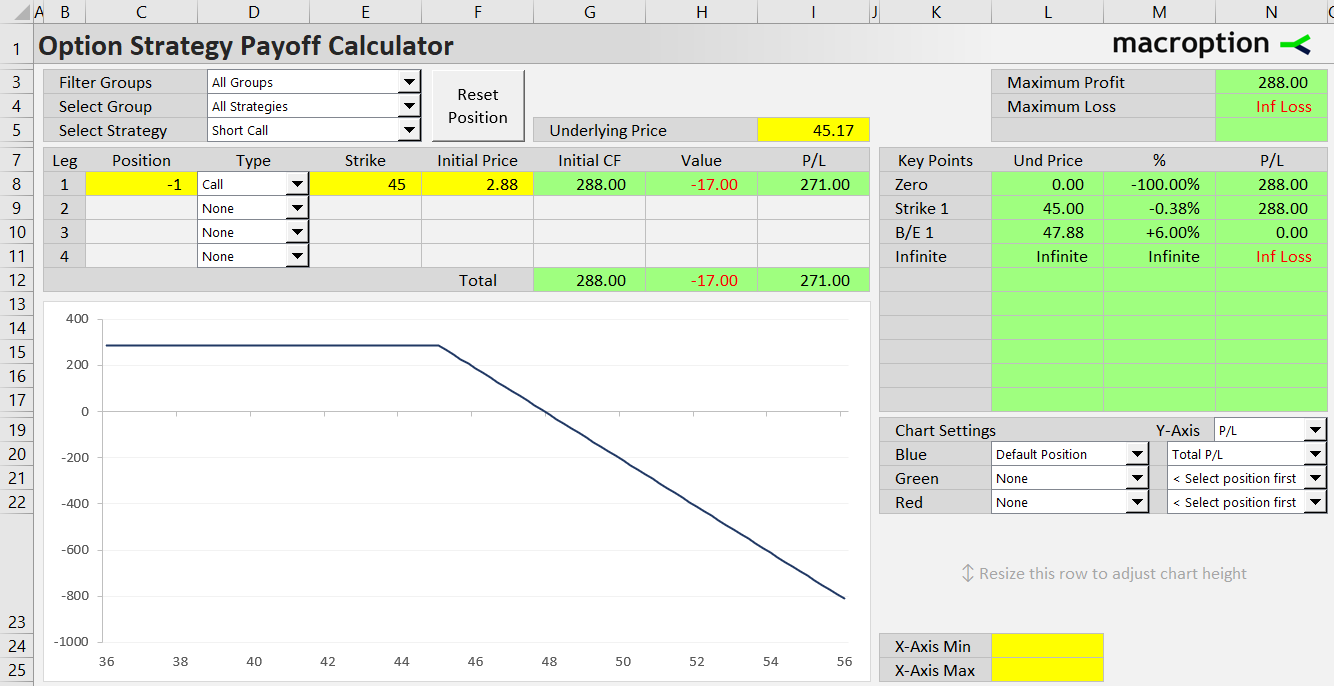

Strategies with unlimited risk and limited profit. These are usually net short call options or net short the underlying asset – they are generally the inverse positions to strategies with limited loss and unlimited profit. One example is short call.

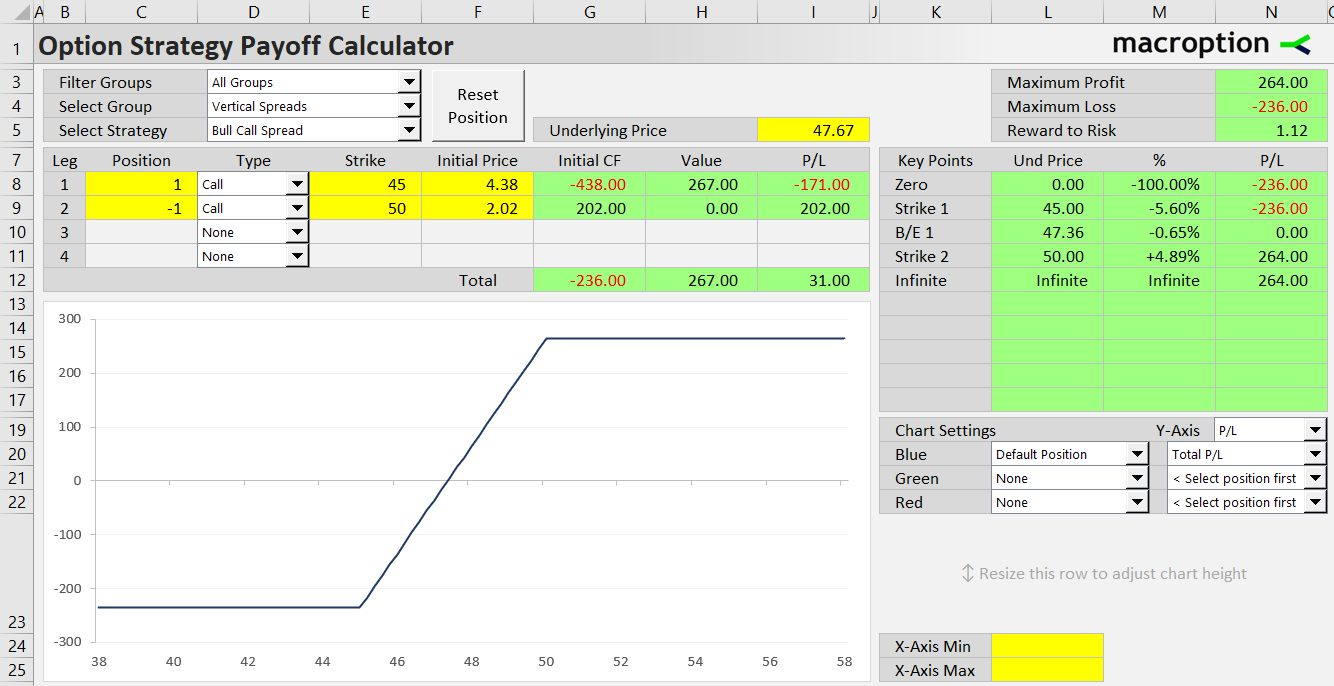

Strategies with limited risk and limited profit. These typically include option spreads, where the risk and profit potential of individual options offset each other. Profit or loss varies between strikes, but it is usually constant below the lowest strike and above the highest strike. Examples include vertical spreads, condors, or butterflies.

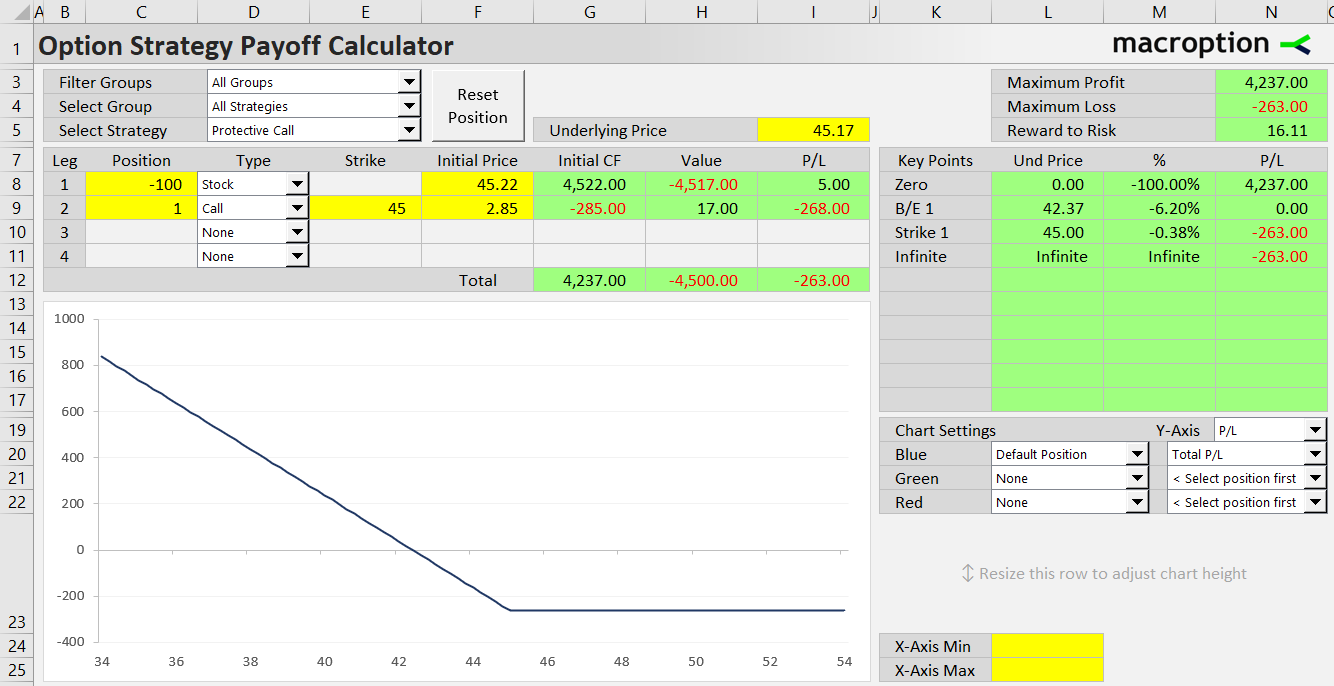

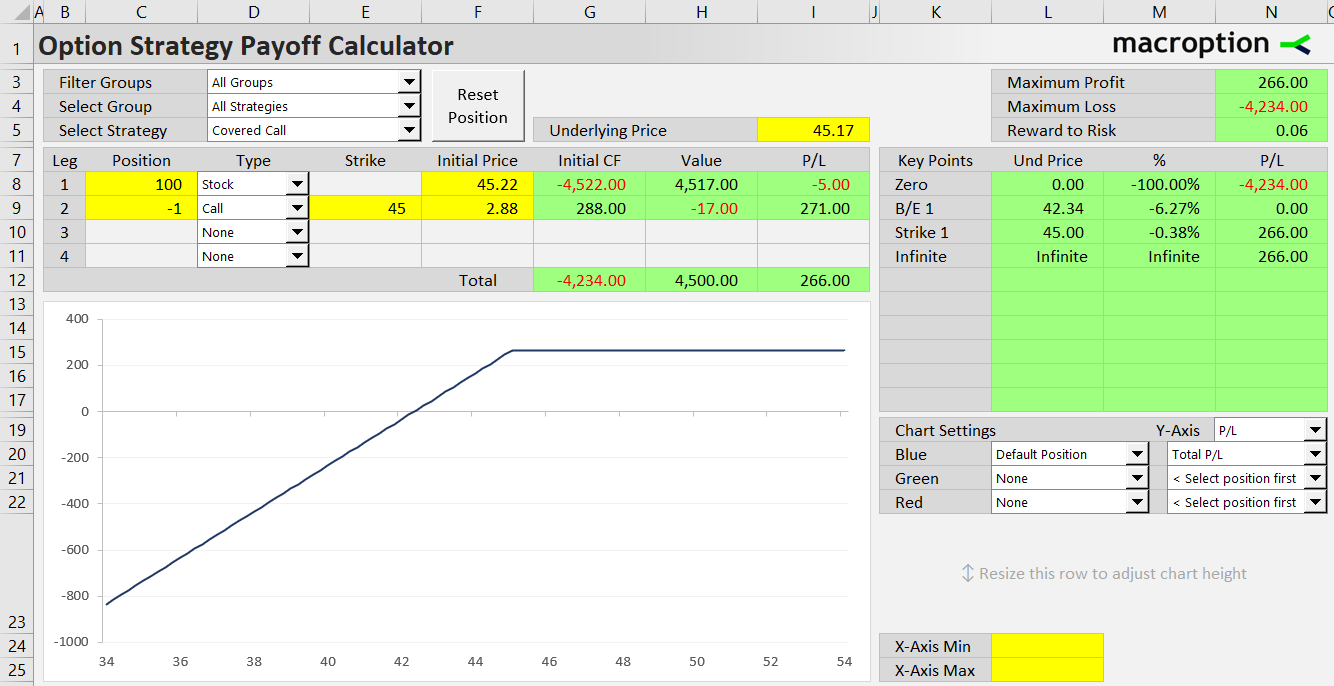

Some strategies have very large potential loss, which almost seems like unlimited, but it is still limited by the underlying falling to zero. These are usually net short put options and/or net long the underlying asset. Typical examples include short put or covered call (the payoff diagram below):

Throughout this website (and in the Option Strategy Payoff Calculator) we classify these strategies as having limited risk, but note that the risk may still be very large.

Similarly, strategies which are net long puts or net short the underlying have technically limited, though very large potential profit. For instance, long put or protective call (below):