The following is a list of all option strategies which consist of two legs.

The List

- Bear Call Spread (also Short Call Spread, Credit Call Spread)

- Bear Put Spread (also Long Put Spread, Debit Put Spread)

- Bull Call Spread (also Long Call Spread, Debit Call Spread)

- Bull Put Spread (also Short Put Spread, Credit Put Spread)

- Call Ratio Backspread

- Call Ratio Spread (also Ratio Call Spread, Bull Ratio Spread)

- Covered Call

- Covered Put

- Long Calendar Call Spread (also Calendar Call Spread)

- Long Calendar Put Spread (also Calendar Put Spread)

- Long Call Synthetic Straddle (also Synthetic Straddle)

- Long Call Synthetic Strangle (also Synthetic Strangle)

- Long Combo

- Long Diagonal Call Spread (also Diagonal Call Spread)

- Long Diagonal Put Spread (also Diagonal Put Spread)

- Long Guts (also Guts)

- Long Put Synthetic Straddle

- Long Put Synthetic Strangle

- Long Straddle (also Straddle)

- Long Strangle (also Strangle)

- Protective Call (also Married Call)

- Protective Put (also Married Put)

- Put Ratio Backspread

- Put Ratio Spread (also Ratio Put Spread, Bear Ratio Spread)

- Short Calendar Call Spread

- Short Calendar Put Spread

- Short Call Synthetic Straddle

- Short Call Synthetic Strangle

- Short Combo

- Short Diagonal Call Spread

- Short Diagonal Put Spread

- Short Guts

- Short Put Synthetic Straddle

- Short Put Synthetic Strangle

- Short Straddle

- Short Strangle

- Strap

- Strip

- Synthetic Covered Strangle

- Synthetic Long Call (also Synthetic Call)

- Synthetic Long Put (also Synthetic Put)

- Synthetic Long Stock (also Synthetic Stock, Synthetic Long)

- Synthetic Short Call

- Synthetic Short Put

- Synthetic Short Stock (also Synthetic Short)

Typical Strategy Groups with Two Legs

There are three main types of option strategies with two legs: spreads, combinations, and strategies which combine an option with a position in the underlying asset.

Option Spreads

Option spreads represent the most common type of option strategies with two legs. Like elsewhere in finance, an option spread combines a long position in one option with a short position in another, similar option. The two legs of an option spread always have the same underlying asset and the same option type (two calls or two puts).

They can have different strikes (vertical spreads), different expiration dates (calendar spreads), or both (diagonal spreads).

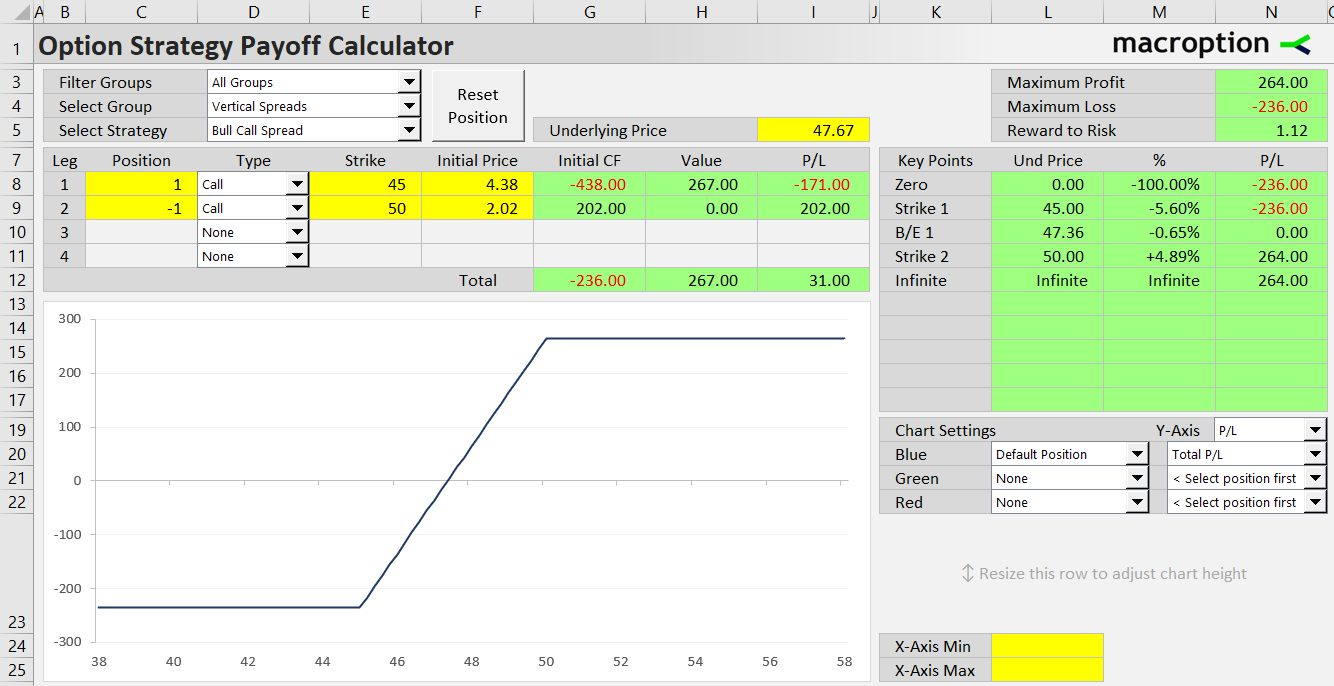

For instance, bull call spread (one of vertical spreads) consists of two call options, one long and one short, with same expiration and different strikes:

A special type of option spreads are ratio spreads and backspreads, where the position sizes of the two legs are different, creating an asymmetric directional exposure.

Option Combinations

Unlike spreads, where the two legs typically have the same option type (call or put) and different direction (long and short), with option combinations it is the opposite: one leg is a call and the other is a put, and both are long or both are short.

Typical examples of option combinations are straddles and strangles.

Strategies with Underlying

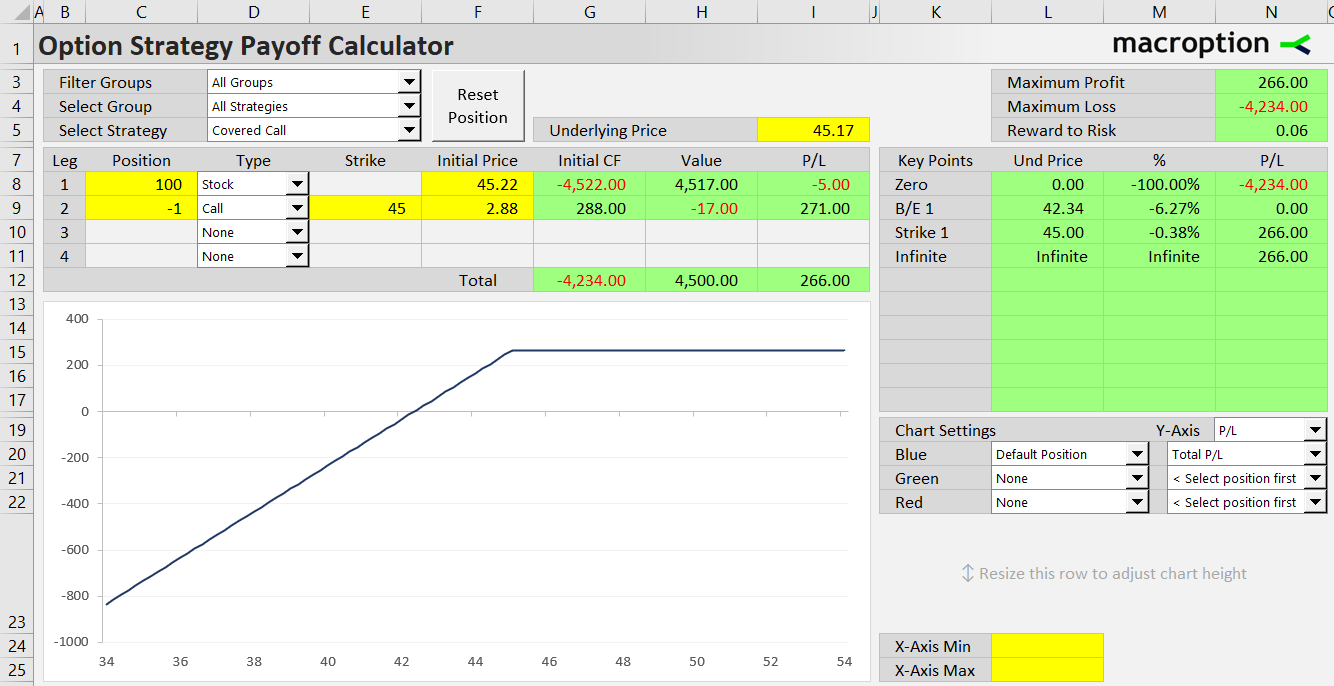

The best known strategies which combine an option with a position in the underlying are covered call (long underlying and short call option) and protective put (long underlying and long put option).

In fact, to some extent, these strategies can be considered a special case of either option spreads or combinations. With some simplification (such as different treatment of dividends), a long position in the underlying is quite like a call option with strike zero. Therefore, a covered call works quite like a bull call spread with very wide gap between strikes (and again, there are dividends, taxes, and other factors which make an underlying position different from a hypothetical zero strike call option).

Other Option Strategies

See also list of option strategies with three legs and four legs.