Synthetic call is a bullish synthetic option strategy with two legs. It replicates the long call strategy, using long position in the underlying and a long put option. Like long call, it has limited loss and unlimited potential profit.

Setup

Synthetic call is a combination of long position in the underlying asset (which creates the unlimited upside potential like a call option has) and long put option (which limits risk on the downside). To create a synthetic call:

- Buy the underlying asset.

- Buy a put option.

Example

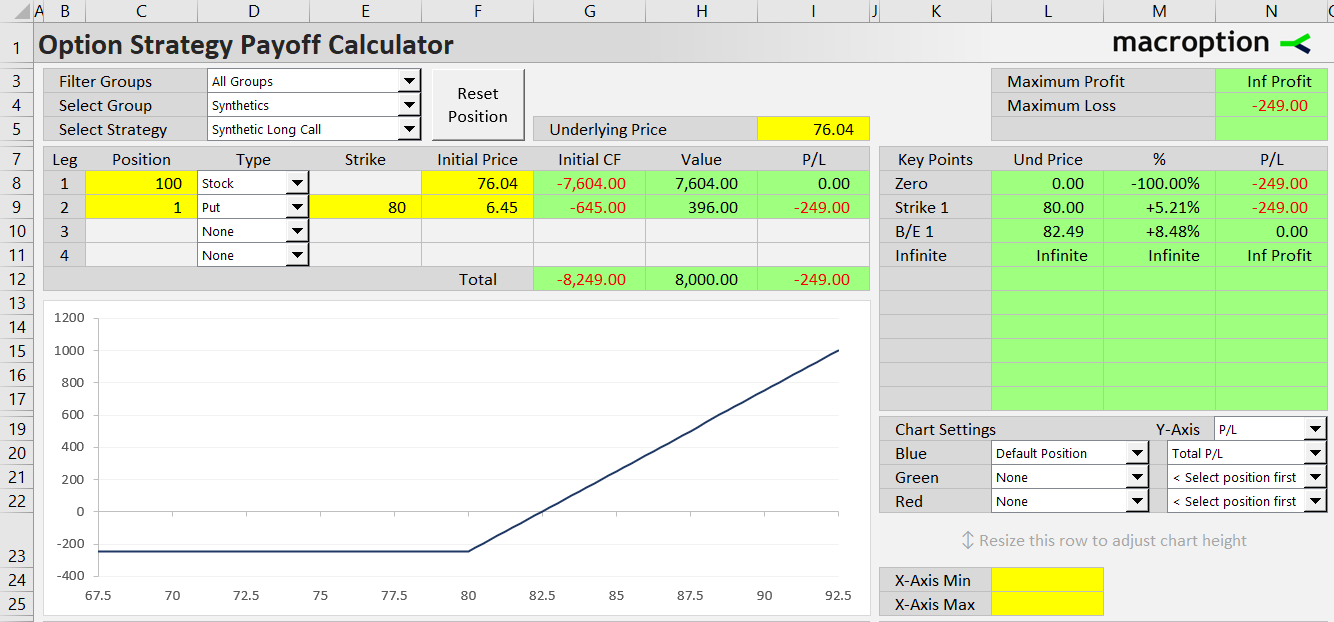

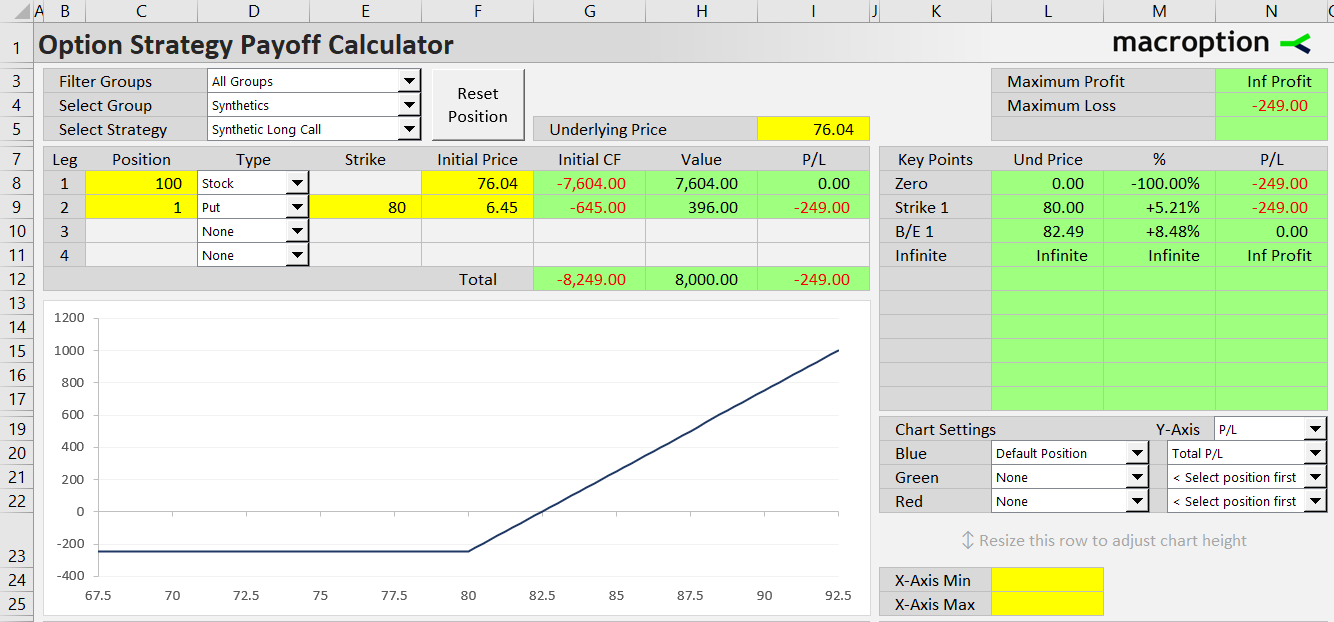

- Buy 100 shares of the underlying stock for $76.04 per share.

- Buy one contract of the 80-strike put option on that stock for $6.45 per share.

It is important to match the position sizes – 100 shares of the underlying stock for every put option contract (if one option contract represents 100 shares as for US traded stock options).

Payoff

The position replicates a call option with the same strike as the long put option used. In our example, the payoff diagram looks exactly like a 45-strike call option:

- Constant limited loss for any underlying price below the strike.

- Upward sloping line above the strike, with theoretically unlimited potential profit.

Cash Flow

While payoff is the same as a plain call option, synthetic call has very different cash flow.

Initial Cost

With a long call option, you only need to pay the option premium to enter the position:

Long call initial cost = call premium

With synthetic call, you need to buy the put option and pay the put premium, but most importantly you also buy the underlying stock, which represents a much higher initial cash payment.

Synthetic call initial cost = underlying price + put premium

In our example, initial cost is $76.04 per share for the stock plus $6.45 per share for the put option, or $82.49 per share ($8,249 per contract) for the entire synthetic call – more than the underlying stock price at the time.

Cash Flow at Expiration

The difference in initial cost is fully compensated at expiration.

If you want to hold the underlying stock after expiration, with synthetic call you already have it, but with plain long call you need to get it.

If underlying price is above the strike, the long call holder exercises the option (which is in the money) and pays the strike price.

If underlying price is below the strike, the long call holder just buy the stock in the stock market and pays the (lower) underlying price. The synthetic call holder already has the stock, but he can also sell the put option just before expiration and receives approximately the difference between strike price and underlying price.

The either scenario, the resulting profit or loss from the trade (the sum of initial cash flow and expiration cash flow) is the same for long call and synthetic call, only the cash flow timing differs.

It is similar if you prefer to not own the stock after expiration. With synthetic call, you sell the underlying (either directly or by exercising the put). With plain long call, you may sell the option just before expiration if it is in the money. Again, total outcome is the same for either strategy.

Dividends

Another important difference between long call and synthetic call is dividends. Because synthetic call includes long position in the underlying stock, its holder is entitled to any dividends which the company pays out at any time after entering the position. On the contrary, a call option holder does not get dividends.

Does this mean a synthetic call is automatically better than plain long call because we get extra dividends?

Not really. In most cases, dividend payments are known in advance and already reflected in the relative prices of call and put options. The higher the dividend, the more expensive put options are relative to calls, which means higher cost to establish a synthetic call position (which includes a put option) compared to a plain call option.

Related Strategies

- Long call – plain long call option, which has same payoff as synthetic call

- Synthetic put – short stock and long call creates a payoff similar to long put

- Synthetic long stock – long call and short put replicate long position in the underlying

- Synthetic short stock – the inverse of synthetic long stock (short call and long put)