Synthetic put is a bearish synthetic option strategy with two legs. It replicates the long put strategy, using a short position in the underlying and a long call option. Like long put, it has limited loss and limited profit (although the profit can be very large if underlying falls a lot).

Setup

To create a synthetic put option position:

- Sell short the underlying asset.

- Buy a call option.

Example

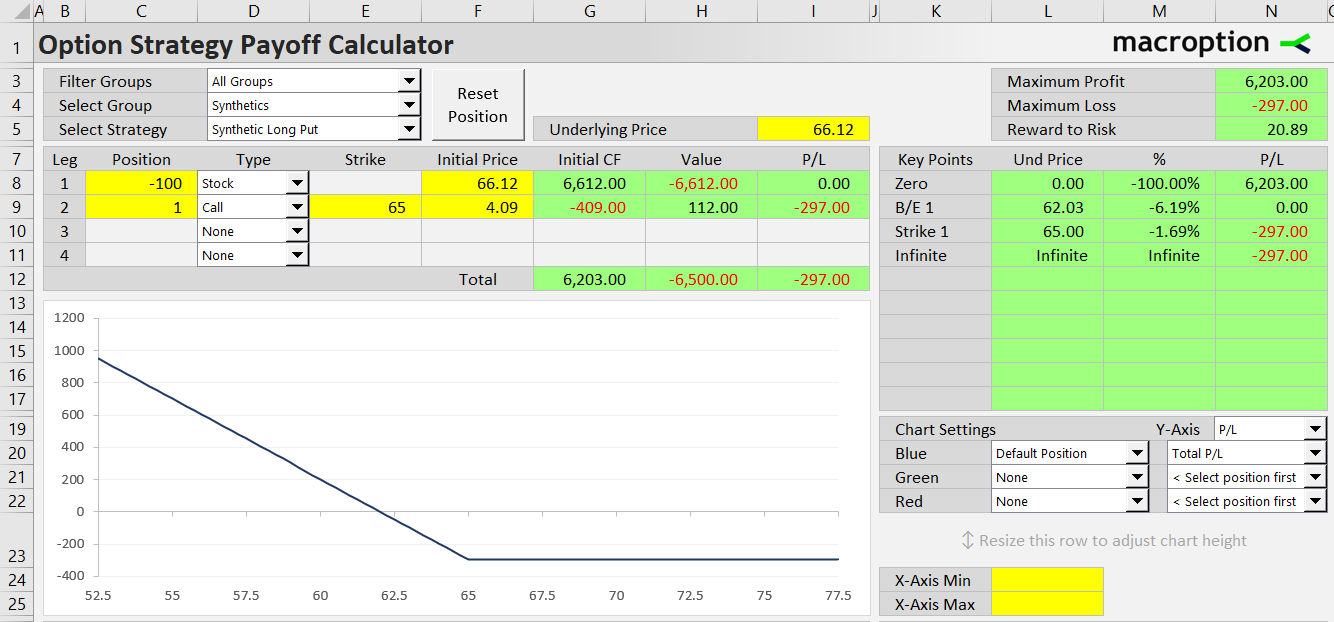

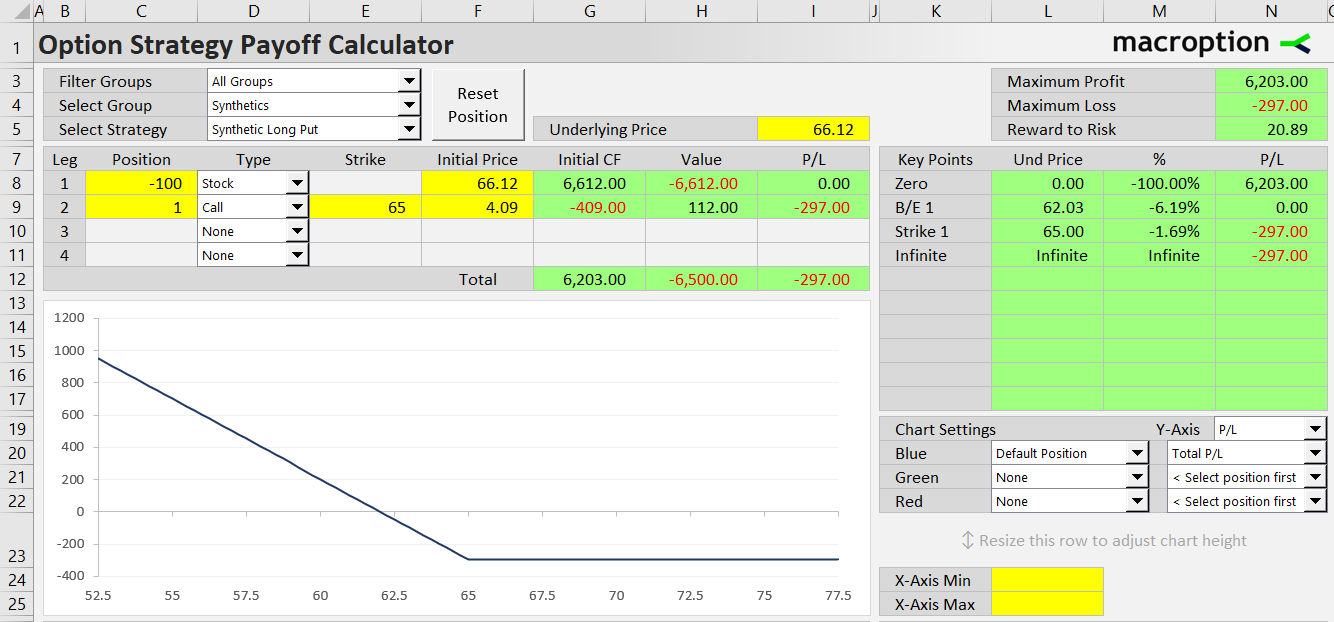

- Sell short 100 shares of the underlying stock for $66.12 per share.

- Buy one call option contract with strike price $65, which costs $4.09 per share.

This position replicates one contract of a put option with strike $65 (same strike as the call option bought).

For the position to match long put, the number of underlying shares sold for each call option contract bought must exactly equal option contract size.

For instance, if one option contract represents 100 shares of the underlying (as for US traded stock options), one put option contract is replicated by buying one call option contract and selling short exactly 100 shares of the underlying stock.

Payoff

Synthetic put strategy payoff is the same as plain long put option.

If underlying price ends up at or above the strike at expiration, the trade results in a constant, relatively small loss.

Once underlying price falls below the strike, total P/L starts to improve and eventually turns positive.

Maximum profit is reached at zero underlying price.

Cash Flow

Although the payoff at expiration is the same as long put, synthetic put has different cash flow.

Initial cash flow is positive, as the amount received for selling short the underlying is greater than the amount paid for the call option.

Synthetic put initial cash flow = underlying price – call premium

At expiration, a considerable cash amount is needed to buy back the short underlying shares, either by exercising the call option (if it is in the money) or directly in the stock market.

Short Selling Regulations and Liabilities

Because synthetic put includes short underlying position, it is subject to all regulations and liabilities normally applying to short selling, including (but not limited to) the following:

- Margin requirements.

- Short selling restrictions at times of market distress.

- The liability to pay dividends.

Related Strategies

- Long put – plain long put option, which has same payoff as synthetic put

- Synthetic call – long call option position replicated with long underlying + long put

- Synthetic long stock – long underlying position replicated with long call + short put

- Synthetic short stock – the inverse of the above (short underlying position with short call + long put)